Can Mutual Funds make me a crorepati in 10 years? How much should I invest to earn Rs. 1 crore?

Most of us grew up with the aspiration to become a crorepati. While investing in mutual funds can help us become a crorepati, it will not happen overnight. So, it is a good thing that you have given yourself 10 years to accumulate Rs. 1 crore.

To have Rs. 1 crore within 10 years, you can invest in Equity Mutual Funds. These schemes can be volatile in the short-medium term, but they can give double-digit returns in the long term.

Moreover, you need to have the discipline to become a crorepati. One of the best ways to ensure disciplined investing is to invest through a Systematic Investment Plan(SIP). That is because even relatively small SIP investments in Mutual Funds made over the long term can grow your wealth significantly.

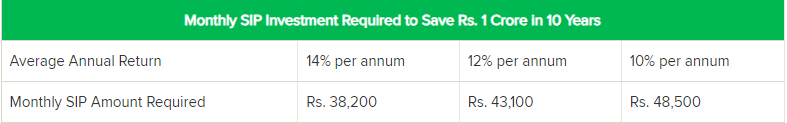

The monthly SIP amount you will require to accumulate Rs. 1 crore in 10 years will depend on the returns you earn from your investments. While there is no certainty about returns, we can use past returns as a reference point to determine what returns you can expect.

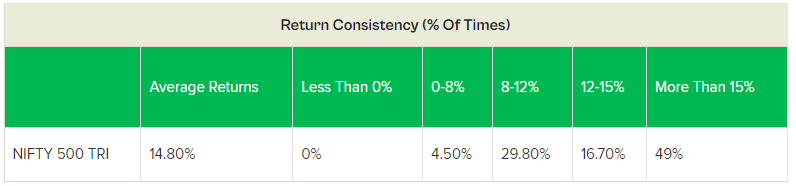

For example, in the last 25 years, the broad NIFTY 500 index had delivered more than 8% returns on 95 out of 100 occasions when an investor stayed invested for at least 10 years. And the average return from the NIFTY 500 index stands at over 14%.

Therefore, you can expect a 10-14% average annual return if you invest in a diversified equity fund and stay invested for at least 10 years. Based on this possibility, let’s see how much you would need to invest every month in reaching the Rs. 1 crore target.

It would be better to assume that you will get the lowest return from the above table and pick the SIP amount based on that number. If you get a higher return, you will have a bigger bank balance, which is never bad.

For more details, please contact our team.