Plan for your family

What is a Guaranteed Return Plan?

A Guaranteed return plan helps you save fixed amount regularly over a long term and provides guaranteed returns for your future, along with customisable return or income options as per your requirements. In this, you pay a regular amount or deposit amount in lump sum after which you get payouts. Further, in case of any unforeseen event, you family members can use this payout to live a comfortable life.

These plans are suitable for people who want to keep their money safe and get a guaranteed return instead of taking risks with potentially higher but uncertain returns influenced by the market. This plan enables you to save for your future expenses while providing a life cover that protects your family members in your absence.

Features of Guaranteed Return Insurance Plans in India

Here are the features of the guaranteed return plans:

Guaranteed returns: These plans provide you with guaranteed income over a specified period, which can be in the form of a lump sum, short-term, long term and immediate income to fulfill your life objectives such as securing a child’s education, buying a new house or accumulating a corpus for retirement at early ages.

Flexibility in choice of returns: Plan offers the option to get guaranteed lump sum amount, income for long term, short term or immediate income depending on your goals and requirements.

Guaranteed Additional benefits to increase corpus: In case of choosing an endowment plan, a percentage of guaranteed maturity benefit will be accumulated each year of policy that can help increase your corpus every year.

Life insurance coverage: Guaranteed return plan protects your family members with a secure life coverage under different plan options from the date of issuing policy.

Easy premium payment: Plan provides you flexibility in paying premium amount in single, annual, half-yearly, quarterly, monthly premium payment mode.

Benefits of Guaranteed Return Plans

These plans provide a range of benefits to policyholders, including the following:

100% guaranteed return plans are zero risk investment options for the assured as they are not market-linked and returns will be received from the first day.

Maturity Benefit

Guaranteed Return Plans offer a guaranteed sum assured along with a basic reversionary bonus and a terminal bonus if applicable at the end of the policy term.

Death Benefit

In the unfortunate event of the policyholder’s demise during the policy term, the nominee or beneficiary receives the death benefit with the reversionary bonuses and terminal bonus, if any. The payouts are carried out for the next 15 years or as mentioned in the policy.

For example, let’s say Rakesh has a life insurance policy with a 20-year term. He names his wife, Arpita, as the beneficiary. Unfortunately, Rakesh passes away five years into the policy term. As per the terms of the policy, Arpita will receive the death benefit, which includes the Life Cover plus any accumulated reversionary bonuses. Additionally, if there is a terminal bonus specified in the policy, Arpita will receive that as well.

Additional Rider

Guaranteed Return Plans often offer optional riders or add-ons that policyholders can purchase to enhance the coverage. These riders provide additional benefits or cover specific risks. For example, riders such as accidental death benefit, critical illness cover, or waiver of premium benefit can be added to the base policy for a comprehensive coverage solution tailored to the policyholder’s needs.

Simplicity and Accessibility

Guaranteed return plans are often straightforward and easy to understand. The investment process is typically hassle-free, with minimal paperwork and administrative requirements. Buying the Guaranteed Return Plan online provides the customer with extra benefits like no hidden charges, full transparency, and clear explanations of charges and returns. The easy accessibility makes these plans suitable for a wide range of investors, including those who may not have extensive knowledge or experience in complex investment products.

Diversification and Risk Mitigation

Including guaranteed return plans in an investment portfolio can contribute to diversification and risk mitigation. While it is important to have a diversified investment strategy that includes various asset classes, adding a guaranteed return plan provides stability and balance to the overall portfolio. This can help offset the potential risks associated with other investments in the portfolio.

Tax Benefits Under Guaranteed Return Plans

Let’s explore the tax benefits associated with guaranteed return plans:

Tax Benefits on Investment:

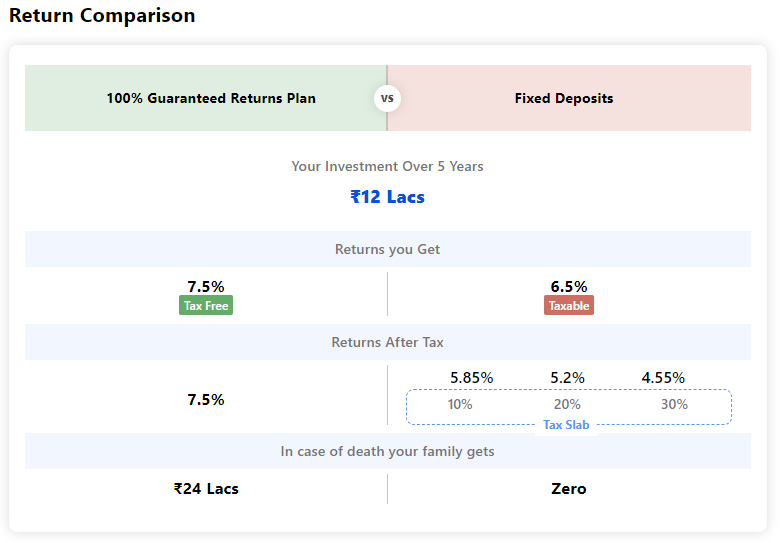

When you invest in a guaranteed return plan, you are eligible for tax benefits under Section 80(C) of the Income Tax Act, 1961 with a maximum limit of 1.5 Lakhs. This means that the maximum amount you invest in these plans is deducted from your taxable income. By utilizing this provision, you can reduce your overall tax liability.

Tax Benefits on Returns:

Another benefit of guaranteed return plans is the tax advantages on the returns you receive. Under Section 10(10D) of the Income Tax Act, the maturity amount from these plans is exempt from taxation. This ensures that the returns you earn on your investment are not subject to income tax, providing you with additional savings.

It is important to note that starting from 31st March 2023, guaranteed plans with an annual premium exceeding 5 lakhs will be taxed according to the applicable tax slabs. This means that if your annual premium for a guaranteed plan is above 5 lakhs, the taxation will be based on the prevailing tax rates.

How Does a Guaranteed Return Insurance Plan Work?

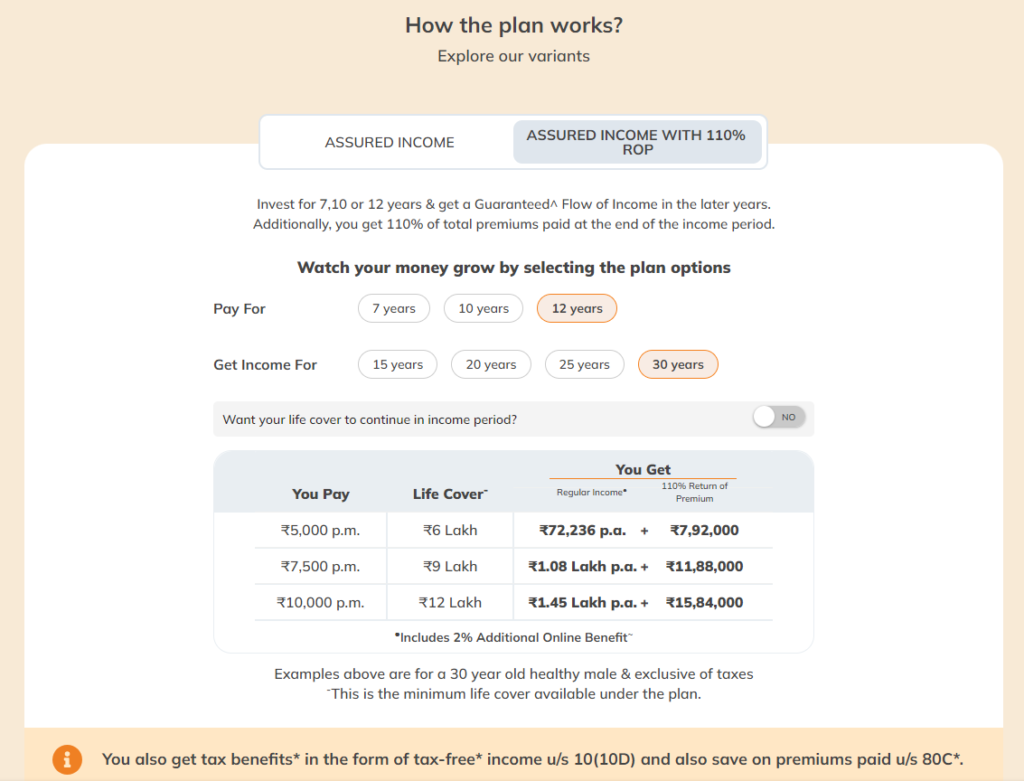

In Guaranteed Return Plans in India, the policyholder pays a premium to the insurance company. In return, the insurer guarantees a certain rate of return over a specified period, typically ranging from 5 to 30 years.

The rate of return offered by the insurer may vary depending on the market conditions and prevailing interest rates at the time of purchase.

Unlike traditional life insurance policies, where the death benefit is the primary focus, the Guaranteed Return Insurance plan is designed to provide a guaranteed return on investment.

The policyholder can choose to receive the payout at the end of the policy term or opt for regular payouts during the policy term.

The policyholder may also have the option to surrender the policy before the end of the policy term and receive a lump sum payout.

What are the Factors to Consider when Buying Guaranteed Return Plan?

Consider below-mentioned factors to buy a guaranteed insurance plan in India:

Determine your financial goals: Like all investments, guaranteed return plans should align with your goals. Consider what stage of life you’re in and what you’re saving for, such as securing your child’s future, creating a second income stream, or planning for retirement.

Seeking guaranteed returns: If you’re risk-averse and prefer a guaranteed return on your investment, then a guaranteed return plan is the right fit. These plans offer a guaranteed payout, regardless of market fluctuations.

Long-term savings: Guaranteed return plans are long-term investments because they have a lock-in period, ranging from 5 to 30 years. If you’re looking for a savings plan that will generate a fixed income stream in the long run, guaranteed return plans are an option to consider.

These plans also offer a secure investment option for short-term savings by providing a fixed rate of return within a specific period. They ensure that the invested amount will be returned with guaranteed interest, making them suitable for individuals looking to protect their principal and earn a predictable income in a short timeframe as well.

Planning for retirement: Guaranteed Return Insurance Plans are ideal for individuals with a low-risk tolerance who prefer stability over higher potential returns and are looking for a fixed income stream during retirement.

Portfolio Diversification: Portfolio diversification refers to spreading your investments across different asset classes, sectors, regions, and financial instruments to manage risk and optimize returns. Diversification helps reduce the impact of potential losses in any single investment and enhances the stability of your portfolio. When implementing portfolio diversification in guaranteed return plans, the main goal is to allocate your investments strategically across various asset classes such as stocks, bonds, cash equivalents, and alternative investments. This diversification helps balance the risk-reward profile of your portfolio.

Life Cover: Life cover, or life insurance, is a financial product designed to provide a sum of money to your beneficiaries upon your death. It acts as a financial safety net, ensuring that your loved ones are financially protected in the event of your untimely demise.While life cover is not directly related to portfolio diversification, it is an important consideration for comprehensive financial planning. Including life cover in your financial strategy can provide financial security to your dependents and help them meet their future needs, such as mortgage payments, education expenses, or daily living costs.