national pension scheme

What is National Pension Scheme?

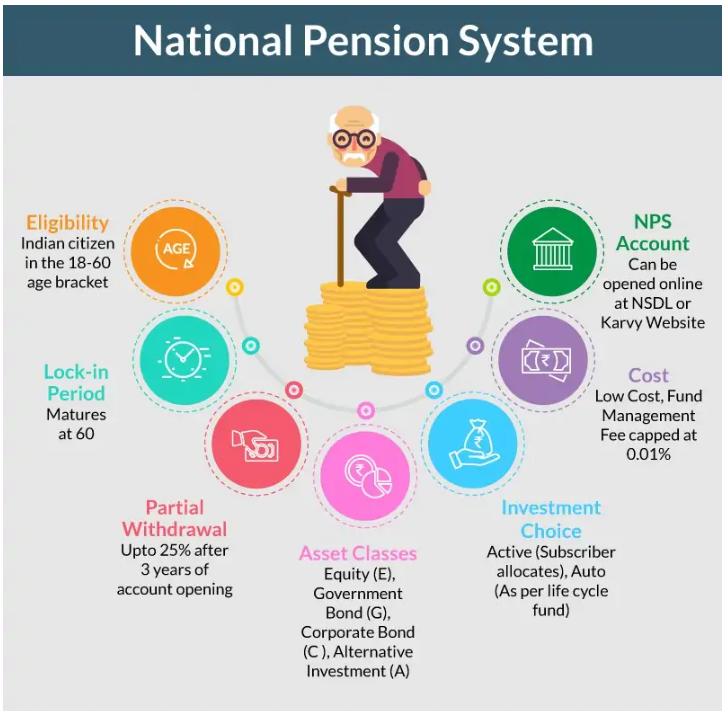

NPS (National Pension Scheme) is an initiative by the Central Government open to employees from public, private and unorganized sectors. Earlier, this scheme was open only to public sector employees. Now, it allows all Indian citizens to opt for a voluntary scheme.

An investor can invest during the period of his/ her employment at regular intervals. Furthermore, it allows an investor to withdraw a percentage of the accumulated amount after retirement and the rest is invested in annuity. The investor receives the remaining amount monthly as a pension post-retirement. Moreover, investment in NPS gives investors tax benefits up to Rs 1.5 lakh under section 80C and up to Rs 50,000 under section 80CCD.

How NPS Works?

NPS is one of the retirement investment options that allows citizens of India (residents and non residents) to invest a sum of money regularly in their retirement account. Also, it is a safe and long term investment option that allows investors to earn market based returns.

Once the investor opts for the NPS investment option, they are allotted a Permanent Retirement Account Number (PRAN).

The NPS subscriber can now contribute regularly towards the NPS scheme until the age of retirement. Upon retirement, the investor can also withdraw a partial amount in lumpsum. The rest is allocated to purchasing an annuity plan.

Annuity is the monthly sum that the NPS subscriber receives from an Annuity Service Provider (ASP). An annuity service provider is a licenced insurance provider.

Furthermore, it is mandatory for the annuity service provider to be empanelled by PFRDA to provide Annuity services to the NPS Subscribers. Also, there are different annuity schemes available for investors to choose from. For example, annuity for life and annuity for life with return of purchase price on death.

NPS Employer Contribution

Employers can also contribute towards their employee’s NPS account. It is mandatory for Government offices to contribute towards their employee’s NPS account. While it is voluntary in the case of corporates (unless specified otherwise). You can avail an additional tax deduction of 10% of basic + DA under Section 80CCD(2) irrespective of any limit. This is over and above the overall ceiling of INR 1,50,000 under Section 80CCE. In simple terms, you can avail additional tax deductions on your employer’s co-contribution (10% of your salary).

NPS Benefits in India

NPS (National Pension Scheme) is a good retirement solution for an investor who wants a regular income source post-retirement and also wants to save tax. Since the Central Government regulates the scheme, the risk is also low. However, risk also depends on an individual’s earnings and cost of living. Furthermore, it differs on how much risk an investor is ready to take given his earnings and expenses.

Systematic investment in the National Pension Scheme during employment leads to a systematic and regular source of income after retirement, especially for private and unorganized sector employees.

What are the disadvantages of NPS?

The NPS (National Pension Scheme) has its disadvantages compared to other investment and pension-related options. The following are the disadvantages of investing in the NPS scheme.

No pension or annuity

The biggest myth about NPS is that it will provide a monthly pension when the person retires. However, this scheme helps to accumulate retirement corpus. Through this corpus, the subscriber can buy an annuity product or a pension product.

Tax implications

Even though the investment in NPS exempted under Section 80C, the corpus accumulated at the time of retirement is subject to taxation. Out of the total corpus, the subscriber is allowed to withdraw 60% of the investment once he reaches 60 years of age. This amount is tax-free. The remaining 40% of the investment is used to buy an annuity to provide a monthly pension to the investor, which is taxable.

Restriction on withdrawal

An investor can withdraw only 25% of the total amount if invested continuously for 3 years towards the NPS account. Also, the investor can withdraw only 3 times till they reach the age of 60. Furthermore, there must be a gap of 5 years between the current and previous withdrawal. Moreover, withdrawals are allowed for specific occasions like children marriage, higher education, buying a new house, medical treatment for self or family.

No guaranteed returns

The return of the NPS scheme total depends on the performance of the underlying security, i.e. corporate bonds, government security and equity. Therefore, market fluctuations can affect the return of the funds.

Types of National Pension Scheme

| Particulars | National Pension System Tier I Account Details | National Pension System Tier II Account Details |

| Status | Default | Voluntary |

| Minimum Amount | The Tier I account requires a minimum investment of Rs 500 or Rs 1000 in a year | The tier II account requires a minimum investment of Rs 250 must |

| Maximum Amount | There is no limit on the maximum amount of investment under Tier I account. | There is no limit on the maximum amount of investment under Tier II NPS account. |

| Withdrawals | Not Allowed for Tier I NPS account | Allowed for Tier II Account |

| Tax Benefits | Deduction under section 80C up to Rs 1.5 lakh. Deduction under section 80CCD up to Rs 50000 | Government Employees – Deduction under section 80C up to Rs 1.5 lakhOthers– No deduction |

How to open an NPS account?

An investor can open a National Pension System account both online and offline.

NPS Online Investment Process

Follow the below steps for investment in NPS scheme online and KYC verification

- Visit the eNPS website to register

- Link your mobile number, PAN number and Aadhar number to the account

- Validate your registration using the OTP received at your registered mobile number for a successful KYC verification

- On successful registration, Permanent Retirement Account Number (PRAN) will be received. PRAN is mandatory to login to the National Pension System account

NPS Offline Investment Process

Follow the below steps to apply for an NPS account offline

- Visit the nearest Point of Presence (POP) center branch, post office or bank branch and collect the application form

- Fill the application form, sign and submit along with Know Your Customer (KYC) documents.

- On the first investment towards NPS, the POP center will send the PRAN along with the password

- A registration fee of Rs 125 is applicable for offline registration

Who are pension fund managers?

Pension fund managers are similar to mutual fund managers. They are authorized personnel to manage the pension fund. Also, they accept investments from NPS investors. Pension fund managers invest the collected funds as per the investor’s requirements under the guidelines of Authority and Investment Policy. Moreover, they also perform periodic review of the underlying assets. For all the services that they provide, they charge a small fee. Following are the 8 pension fund managers in India.

- Kotak Mahindra Pension Fund Limited

- Aditya Birla Sun Life Pension Management Limited

- SBI Pension Funds Private Limited

- UTI Retirement Solutions Limited

- Reliance Pension Fund

- ICICI Prudential Pension Funds Management Company Limited

- LIC Pension Fund

- HDFC Pension Management Company Limited

National Pension System withdrawal rules

The National Pension Scheme promotes regular investment in a pension account by the investor until retirement and provides a monthly pension after retirement. However, it also allows a partial withdrawal of a certain portion of the amount invested on specific occasions.

The National Pension Scheme allows an investor to withdraw the investment made. These partial withdrawals also come with terms and conditions.

Withdrawals before the age of 60 years

An investor can withdraw up to 25% of the total investment if he has invested for a continuous period of 3 years towards the NPS account. An investor can withdraw 3 times on filing the withdrawal form. Also, there must be a gap of 5 years between the previous and the current withdrawal opted for.

Withdrawals are allowed only on the following specific occasions:

- Marriage of children

- Higher education

- Buying or building a house

- Medical treatment of self or family

Withdrawals after the age of 60 years

- An investor is allowed to withdraw 60% of the investment once he reaches 60 years of age. The rest 40% of investment is retained and invested in annuity to provide a monthly pension to the investor. Also, no tax is levied on the withdrawal of 60% of the investment after the age of 60 years

NPS investment allocation rules

NPS invests in various schemes. Investment in equity is made under the Scheme E of the NPS. An investor is allowed to invest up to 50% of the total investment in equity. Following two equity allocation options are available to an investor:

Active Choice– An investor is allowed to decide the scheme and type of split

Auto Choice– Here the scheme is dependent on the risk profile of the investor and accordingly the scheme and split of investment are decided by NPS. For example- If an investor is old, the choice of investment will be less risky and more stable

Comparison of NPS with other tax saving schemes

Below we have presented a comparison of NPS with other tax saving schemes like Public Provident Fund, Fixed Deposit, and ELSS.

| Scheme | Rate of return | Lock-in Period | Risk | Tax Benefits |

| NPS | 8% to 10% | Till retirement | Depends on market fluctuation | Deduction u/s 80C up to Rs 1.5 lakh. Additional Rs 50000 under section 80CCD (1B)Withdrawal after retirement up to 40% of the fund is tax free |

| Public Provident Fund | 8.10% | 15 years | No-Risk | Principal amount deductible u/s 80C deduction Interest: Tax free, Maturity amount: Tax free |

| Tax Saving Fixed Deposit | 7% to 9% varies Bank to Bank | 5 years | No-Risk | Principal amount deductible u/s 80C deductionInterest: Taxable |

| ELSS | 12% to 14% | 3 years | Depends on market fluctuation | Principal amount deductible u/s 80C deduction. Interest- 10% LTCG. Dividend- 10% DDT |