Know about Mutual funds

Mutual fund investments are becoming very popular with individual investors because of their benefits. Among the many advantages, the most critical factors that drive investors to mutual funds are that investors can-

Start with any amount (as low as 500)

Diversify across multiple stocks and other instruments like debt, gold, etc.

Start automated monthly investments (SIP)

Invest without requiring to open a DEMAT account

1. What are Mutual Funds?

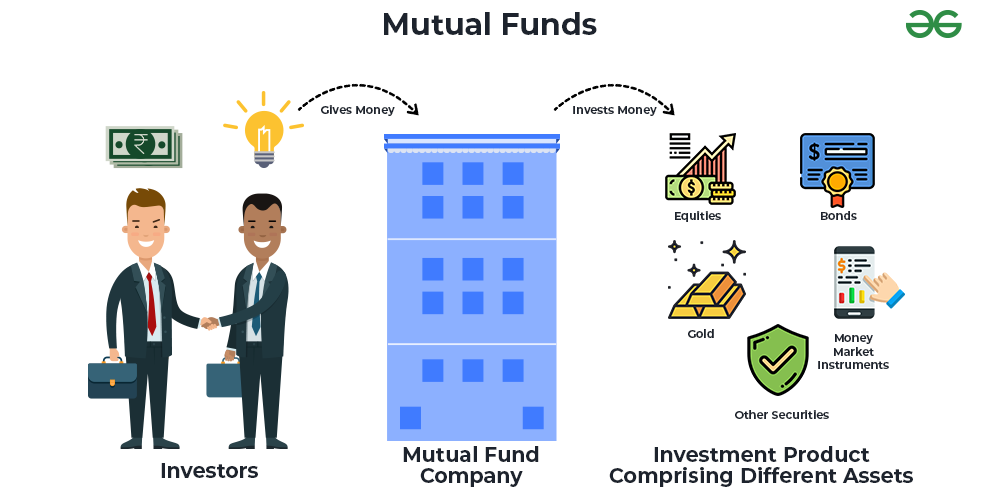

A mutual fund is an investment platform that funds money from several investors and invests these funds in several financial securities like bonds, stocks, shares, money market instruments, gold, etc.

Mutual funds are run by investment professionals who allocate these funds to generate revenue or capital gains for the investors. Small or individual investors have access to professionally managed portfolios of stocks, bonds, and other securities through mutual funds. As a result, each shareholder participates evenly in the fund’s profit or loss.

2. Building a Portfolio of Mutual Funds

The right way of investing is to build a mutual fund portfolio. A portfolio is a collection of mutual funds that helps you meet your investment goals. Your overall returns matter on your broad portfolio and not a particular fund.

Don’t worry connect with us and we will guide you from beginning.