How does Stock market works

It is important to invest money in the right avenues for wealth creation.

Stock market investment is one such lucrative option that rewards investors with high returns over the years. But to make this kind of return, it is important to understand how the equity market works.

Here is what you should know.

Participants of the Stock Market

1) Securities Exchange Board of India (SEBI)

2) Stock Exchange

3) Stockbrokers and Brokerages

4) Investors and Traders

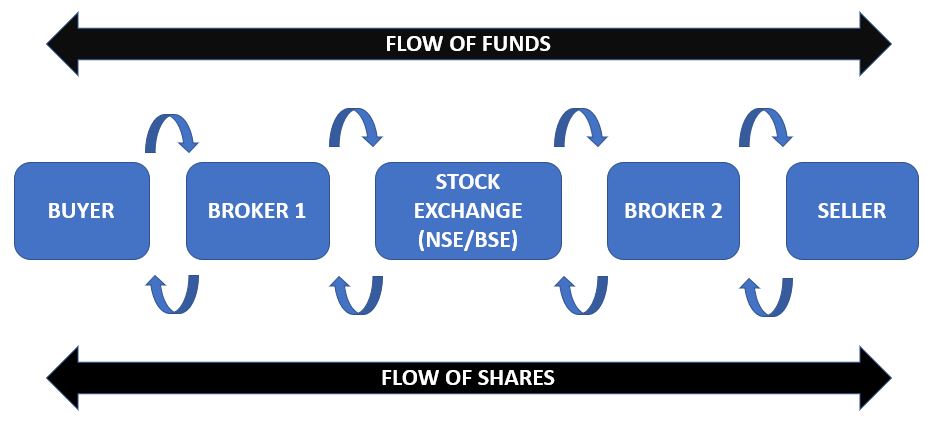

Trading in the Stock Market

For example,

If you buy a stock today, the credit is given by the end of the day. The stock exchange also ensures that the trade of stocks is honoured during the settlement.

If the settlement cycle doesn’t happen in T+2 days, the sanctity of the stock market is lost because it means trades may not be upheld.

Stockbrokers identify their clients by a unique code assigned to an investor.

After the transaction is done by an investor, the stockbroker issues him/her a contract note which provides details of the transaction such as the time and date of the stock trade. Apart from the purchase price of a stock, an investor is also supposed to pay brokerage fees, stamp duty, and securities transaction tax.

In the case of a sale transaction, these costs are reduced from the sale proceeds, and then the remaining amount is paid to the investor.

At the broker and stock exchange levels, there are multiple entities/parties involved in the communication chain, like the brokerage order department, and exchange floor traders.